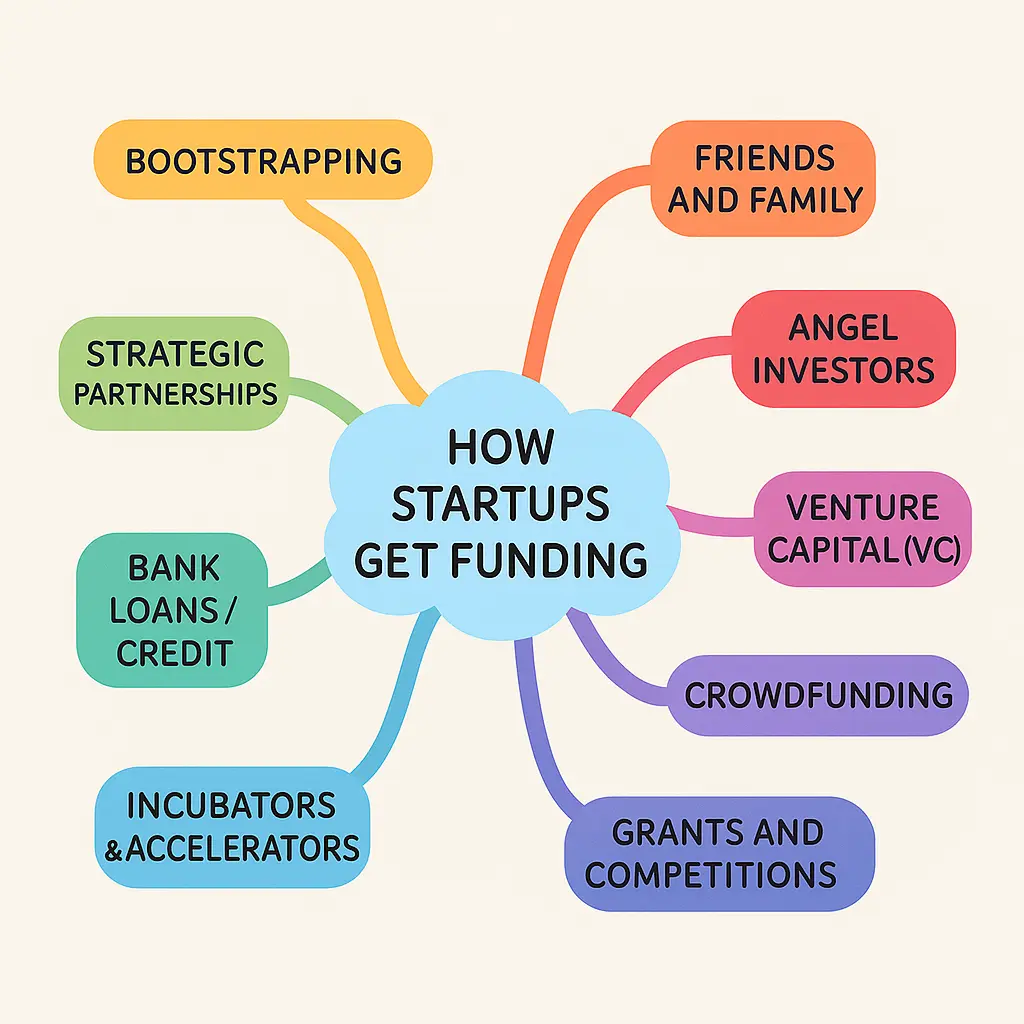

Every great idea needs fuel to become reality—and in the startup world, fuel means funding. Whether you’re building an app, launching a product, or developing a deep tech innovation, you’ll need money to build, test, and scale. But not all funding is created equal.

This guide walks you through different types of startup funding, with detailed explanations, real-life success stories, and a special focus on Indian startups that have made it big.

1. Bootstrapping (Self-Funding)

What is it?

Bootstrapping means using your own savings or personal income to fund your startup, instead of raising external money. You grow slow but retain full control.

Why it works:

- You stay lean and efficient.

- You don’t dilute ownership.

- No pressure from investors.

Global Example:

Mailchimp started in 2001 without a dime from outside investors. The founders reinvested profits, built slowly, and eventually grew the company to $700M+ in revenue before selling to Intuit in 2021 for $12 billion.

Indian Example:

Zerodha, India’s largest stockbroker, was founded by Nithin Kamath in 2010. He built it without VC money. Today, it’s valued at over $2 billion, entirely bootstrapped. “We never spent money we didn’t earn,” he says.

2. Friends and Family

What is it?

Early-stage founders often raise small sums from people they know—friends, family, or relatives.

Why it works:

- Easiest to access.

- Great for seed-stage ideas.

- Trust-based support.

Global Example:

Sara Blakely, founder of Spanx, used $5,000 of her savings and help from family to build a billion-dollar brand without any initial investors.

Indian Example:

Nykaa, founded by Falguni Nayar, started with her own savings and help from close family before raising external capital. Today, it’s publicly listed and valued in billions.

3. Angel Investors

What is it?

Angel investors are wealthy individuals who invest their own money into startups at an early stage, often before product-market fit.

Why it works:

- Early-stage funding with mentorship.

- Flexible and fast decisions.

- Often founders or ex-entrepreneurs themselves.

Global Example:

WhatsApp received a $250,000 angel investment from Jim Goetz of Sequoia Capital when it had no revenue.

Indian Example:

Oyo Rooms secured its first major investment from Lightspeed Venture Partners and angel investors, helping Ritesh Agarwal scale operations.

4. Venture Capital (VC)

What is it?

Venture capital is money provided by investment firms to high-growth startups in exchange for equity.

Why it works:

- Big money to scale fast.

- Access to experienced mentors.

- Prestige and connections.

Global Example:

Uber raised billions in VC funding from top firms like Benchmark and SoftBank.

Indian Example:

Flipkart is one of India’s most iconic VC-backed startups. It raised early funding from Accel and later from Tiger Global, before being acquired by Walmart for $16 billion.

Other Indian VC-backed success stories:

5. Crowdfunding

What is it?

Crowdfunding platforms like Kickstarter or Indiegogo allow startups to raise small amounts of money from a large number of people online.

Why it works:

- Market validation + funding.

- Early community of backers.

- Creative and social ventures thrive.

Global Example:

Pebble Watch raised over $10 million on Kickstarter for its smartwatch idea.

Indian Example:

Platforms like Wishberry and Ketto have helped Indian creators and entrepreneurs fund their projects. For example, Tamul Plates, an eco-friendly startup from Assam, crowdfunded their production setup.

6. Grants and Competitions

What is it?

Grants are non-repayable funds given by governments or institutions. Competitions often award prize money to the most innovative ideas.

Why it works:

- Non-dilutive (you keep your equity).

- Ideal for R&D-heavy projects.

- Good visibility.

Global Example:

Ginkgo Bioworks, a synthetic biology company, got millions in grants before raising VC.

Indian Example:

Forus Health, which creates low-cost eye-care devices, won several innovation challenges and grants early on.

Saathi Pads, which makes biodegradable sanitary pads, won grants from USAID and the UN.

7. Incubators & Accelerators

What is it?

Programs that offer mentorship, small funding, office space, and investor access in return for equity.

Why it works:

- Early-stage guidance.

- Connections to future investors.

- Product-market fit support.

Global Example:

Airbnb joined Y Combinator in 2009, got $20K funding, and was coached into a billion-dollar idea.

Indian Example:

- Meesho – Y Combinator 2016 batch, now a unicorn.

- Razorpay – Y Combinator alum (2015), now one of India’s top fintech startups.

8. Bank Loans and Credit

What is it?

Traditional loans from banks or NBFCs, sometimes with collateral, and sometimes through government startup schemes.

Why it works:

- You retain full ownership.

- Predictable repayment structure.

- Works for asset-heavy businesses.

Global Example:

Under Armour used credit cards and loans in the early days to fund inventory.

Indian Example:

Nirma was founded with a small loan and the founder’s savings.

Government schemes like Mudra Loans and Startup India offer low-interest business loans today.

9. Strategic Partnerships

What is it?

Partnering with a bigger company that benefits from your innovation. Sometimes these partners invest; other times, they help scale.

Why it works:

- Access to bigger customer base.

- Non-traditional funding.

- Mutual benefit.

Global Example:

Spotify integrated with Facebook, which gave it instant access to millions of users.

Indian Example:

Paytm received strategic investment from Alibaba, which helped with tech and scaling.

Reliance Jio partnered with Facebook, Google, and Microsoft to build digital ecosystems.

Final Thoughts

There’s no one-size-fits-all when it comes to funding your idea. You could bootstrap, win a grant, get angel backing, or combine several methods over time. What matters most is:

- Your readiness (idea validation, prototype).

- Your narrative (why you, why now, why this).

- Your network (getting in front of the right people).